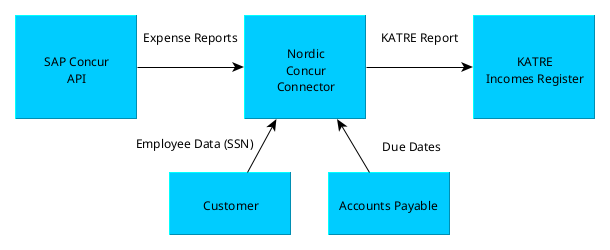

Nordic Concur Connector KATRE integration fetches paid expense reports from SAP Concur and reports the tax free benefits to KATRE according to the rules you have defined.

Finnish tax authority has detailed KATRE pages if you want to learn more about KATRE.

In order to start using Nordic Concur Connector KATRE integration, you need to connect your the Nordic Concur Connector application in the SAP Concur App Center. Search "Nordic Concur Connector" in the SAP Concur App Center, or click this link.

In order to be able to make the connection, your Concur user needs to have Web Services Administration or Company Administration rights. If you do not have the necessary rights, you can ask your Concur administrator to give them to your user.

The connecting process will ask you to provide basic information about your company, like address and VAT ID. You will also need to select the subscription package for your company.

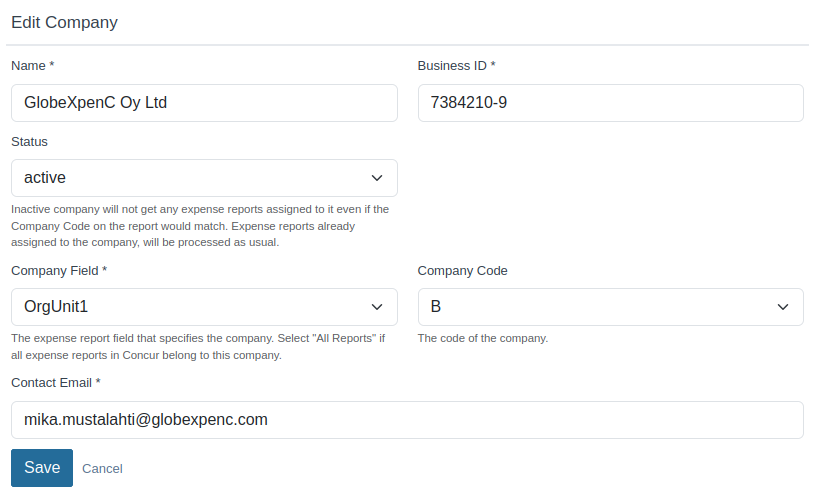

First you need to create up your companies. We need their names, business IDs, contact emails and how we are going to find the expense reports belonging to the company. Company Field is the Concur field that identifies the company, to which the report belongs to. Company Code is the value on the Company Field that belongs to this particular company.

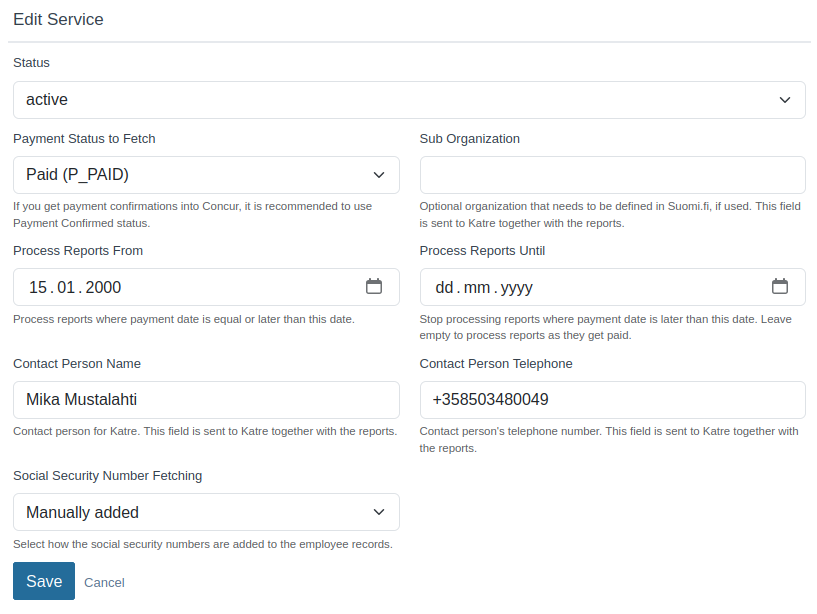

After creating companies, you need to add services to the companies. KATRE service requires the fields described in the image below.

With the Status field, you can stop this service from processing any new expense reports.

Social Security Number Fetching has two options; manual import and LDAP search.

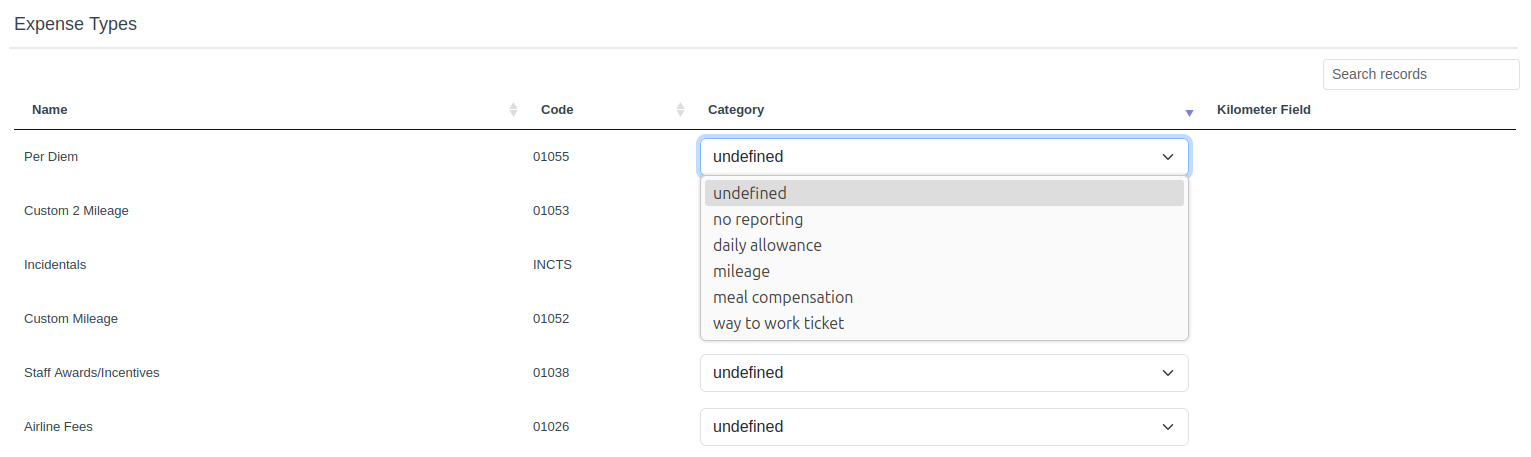

Then you need to categorize the SAP Concur expense types so that our app knows which expenses need to be reported to KATRE. When an expense report contains any expenses whose expense type is not categorized, processing that expense report is halted until all the used expense types are categorized.

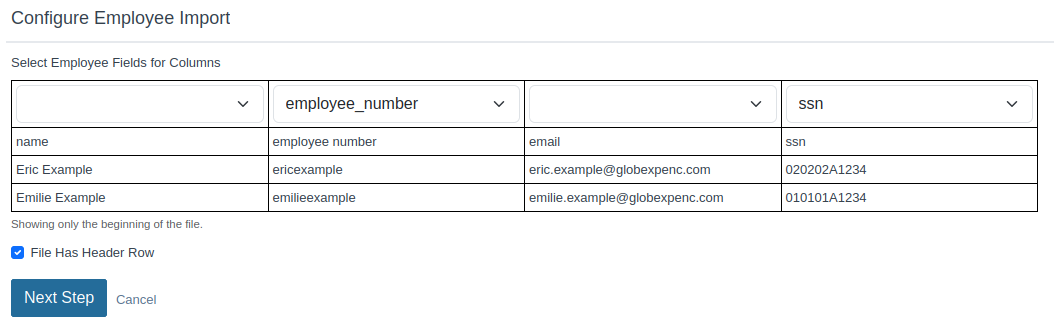

If your company does not have employees Social Security Numbers in LDAP, you can import them into the application from a spreadsheet.

The spreadsheet needs to have employee records on rows and their data in separate columns. One of the columns needs to contain the employee number. Employee Number is used for finding the existing employee record to update. If existing employee cannot be found, the import will create new employee records.

One of the columns needs to be the finnish Social Security Number. Or, if the employee does not have a social security number, KATRE requires; country, first name, last name, gender, date of birth, street address, postal code, post office, post office country, resident status and subject to withhold fields. These can all be imported.

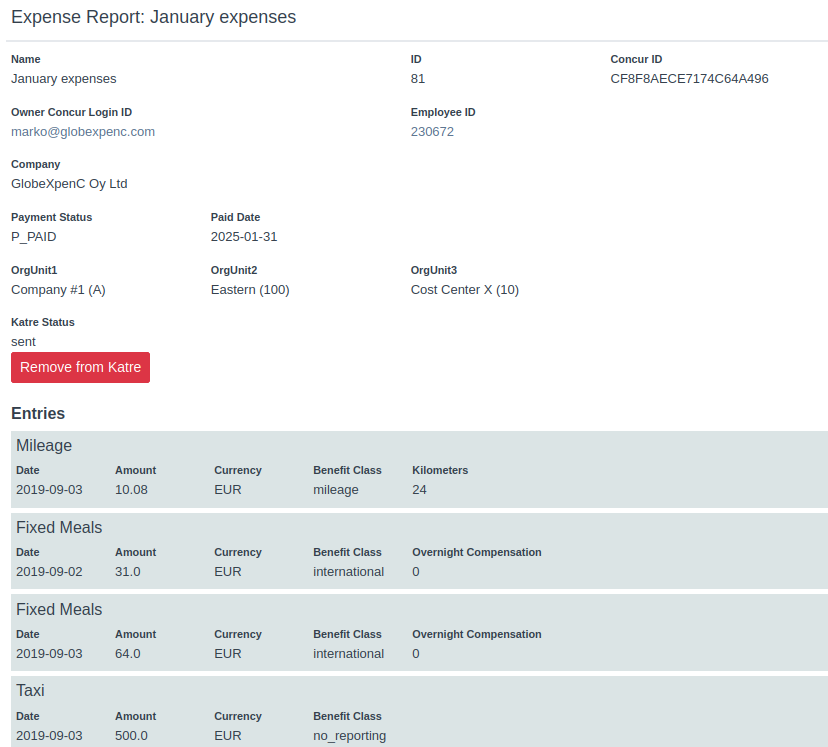

Processed SAP Concur expense reports are listed with their processing statuses.

Report View shows key fields from the expense report and all the expense entries with their expense type categorization. From the report view you can pull the report back from KATRE, if the expense report had incorrect data on it.